Taxes off paycheck

At a possible 90382 401k contribution would allow for zero federal and state income taxes. Step 1 Filing status.

Understanding Your Paycheck Credit Com

The percentage depends on your income.

. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Ad Payroll So Easy You Can Set It Up Run It Yourself. Make Your Payroll Effortless and Focus on What really Matters.

Your bracket depends on your taxable income and filing status. Start wNo Money Down 100 Back Guarantee. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

These are the rates for. Ad Get Help With Your Tax Litigation Case From The Tax Experts at David Lee Rice. Step 3 Taxable income.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. This marginal tax rate means that your immediate additional income will be taxed at this rate. The amount of income tax your employer withholds from your regular pay.

Discover The Answers You Need Here. Ad Compare 5 Best Payroll Services Find the Best Rates. America uses a progressive system in determining what employees pay in income tax.

Federal income taxes are paid in tiers. The same goes for the next 30000 12. Median household income in 2020 was 67340.

For employees withholding is the amount of federal income tax withheld from your paycheck. Step 4 Tax liability. All Services Backed by Tax Guarantee.

Calculate your paycheck in 5 steps. 05 of your unpaid taxes for each month the balance goes unpaid. This means that the amount required by the government is smaller for those.

The maximum penalty the IRS can. If you pay more in estimated taxes you will get a refund within six weeks after the IRS accepts your tax return. For a single filer the first 9875 you earn is taxed at 10.

There are seven federal tax brackets for the 2021 tax year. Form 4868 is a simple one-page form that. Ad Honest Fast Help - A BBB Rated.

Self-employed individuals have to pay the full 29 in Medicare taxes and 124 in Social Security taxes themselves as there is no separate employer to contribute the other half. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. What is the percentage that is taken out of a paycheck.

According to the IRS the fastest and easiest option to file a tax extension is to submit Form 4868 using the IRS Free File service. The penalty is calculated as a percentage of the taxes you didnt pay. 10 12 22 24 32 35 and 37.

My pension is 87000 and Social Security is 27000 a year. Complete a new Form W-4P Withholding Certificate for Pension or. See how your withholding affects your.

Federal Paycheck Quick Facts. Does the Social Security count as income. Federal income tax rates range from 10 up to a top marginal rate of 37.

The payment for the. New York Paycheck Quick Facts. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. You pay the tax on only the first 147000 of. This is tax withholding.

If you pay less in estimated taxes you may face an underpayment. All Services Backed by Tax Guarantee. Step 2 Adjusted gross income.

Call Now for a Consult. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. For instance an increase of.

Federal and state income taxes need to cover the 8031 plus the money allotted to them. New York income tax rate. Get Expert Advice on Tax Litigation Resolution More.

Census Bureau Number of cities that have local income taxes. 1 day agoTax authorities treat Social Security benefits differently. Your average tax rate is 217 and your marginal tax rate is 360.

Ad Payroll So Easy You Can Set It Up Run It Yourself. There are 4 main filing statuses.

Understanding Your Paycheck

Understanding Your Paycheck Direct Deposit Advice Jmu

Pay Stub Meaning What To Include On An Employee Pay Stub

Here S How Much Money You Take Home From A 75 000 Salary

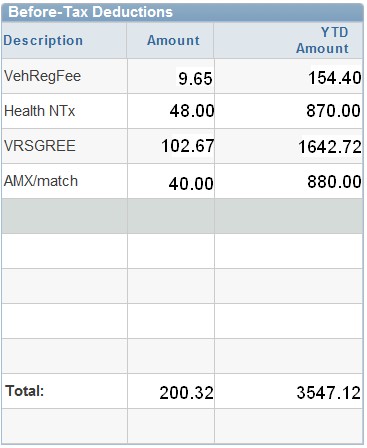

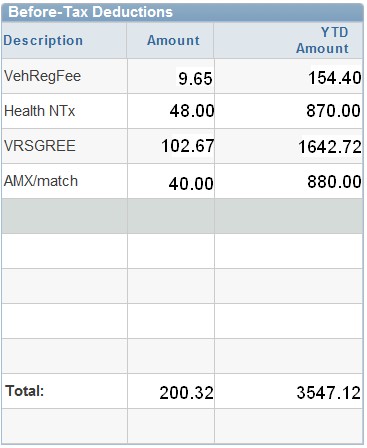

Understanding Your Paycheck Human Resources Northwestern University

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

New York Paycheck Calculator Smartasset

Paycheck Taxes Federal State Local Withholding H R Block

Here S How Much Money You Take Home From A 75 000 Salary

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Check Your Paycheck News Congressman Daniel Webster

Paycheck Calculator Online For Per Pay Period Create W 4

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar